The world of crypto never sleeps, and this week is no exception. From groundbreaking executive orders to innovative ETF applications, the crypto landscape is buzzing with developments that could reshape its future. Let’s dive into the key highlights

Trump’s Digital Asset Revolution Begin

Donald Trump, the newly inaugurated president of the United States, signed a series of crypto-focused executive orders (EO) today, including one to create a “national digital asset stockpile.”

The series of orders includes a designated Presidential Working Group with the goal of strengthening the U.S.’s leadership in digital finance, developing a regulatory framework for digital assets, and evaluating the creation of a strategic national digital asset stockpile, according to Fox.

The working group is set to be led by the newly appointed “AI and Crypto Czar,” and former host of the All-In podcast, David Sacks, alongside the Secretary of the Treasury David Lebryk and the Securities and Exchange Commission (SEC) Chair Mark Uyeda.

In addition to the executive order to further crypto development in the United States, the EO also prohibits agencies from promoting central bank digital currencies (CBDCs).

Crypto traders on social media have been anxiously awaiting the executive orders, In particular, they were hoping for the announcement of a national Strategic Bitcoin Reserve (SBR). Senator Cynthia Lummis, a cryptocurrency advocate, was also elected chair of the Senate Banking Subcommittee on Digital Assets earlier in the day. Upon her acceptance Lummis said in a statement, “ Congress needs to urgently pass bipartisan legislation establishing a comprehensive legal framework for digital assets that strengthens the U.S. dollar with a strategic bitcoin reserve.”

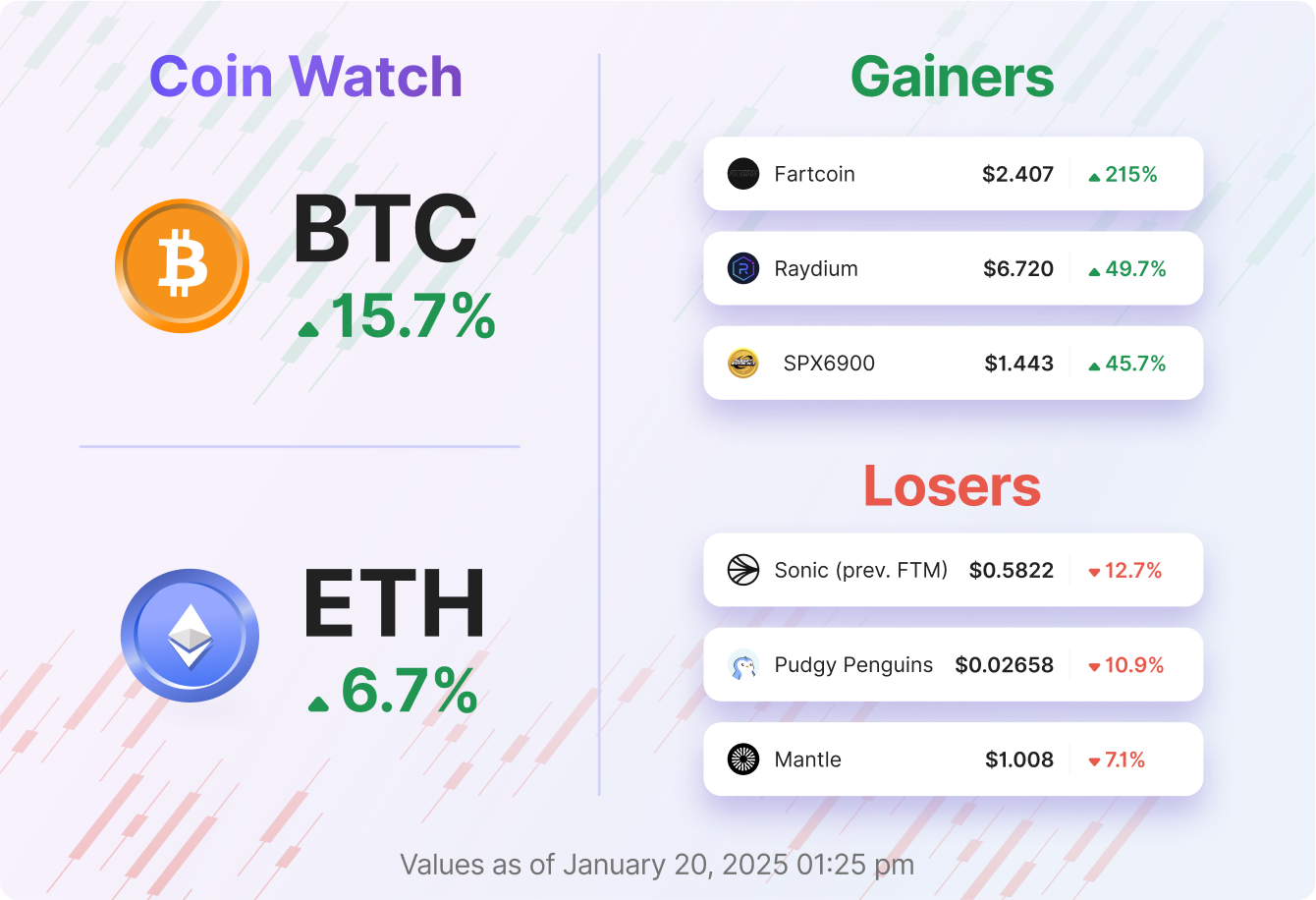

Despite the news, BTC is down 1.5% since the announcements to $103,000.

Grayscale Enters the Litecoin and Solana ETF Race

Grayscale has joined the competitive ETF arena, applying to launch Litecoin and Solana ETFs alongside other innovative products like a synthetic Ethereum ETF and a “Bitcoin Adopters ETF.”

- Litecoin ETFs: Grayscale’s application marks it as the second firm to pursue a Litecoin ETF. However, market interest remains muted due to the lack of recent technical upgrades on the Litecoin network.

- Bitcoin Adopters ETF: This unique product will include stocks of companies holding Bitcoin in their corporate treasury.

- Synthetic Ethereum ETF: Based on Grayscale’s Ethereum Trust, this offering seeks to provide exposure to Ethereum in an alternative format.

The ETF race has intensified following Gary Gensler’s resignation, with firms scrambling to secure approvals. While Grayscale’s initiatives reflect innovation, they face stiff competition and regulatory uncertainties.

Wall Street Banks Can Now Hold Crypto

In a landmark decision, the SEC has overturned SAB 121, a Biden-era rule that penalized banks for offering digital asset custody services. This policy change, led by acting SEC Chair Mark Uyeda, marks a significant win for traditional banks.

- What It Means: Banks can now offer crypto custody services without incurring heavy costs, enabling them to integrate digital assets into their offerings.

- Industry Reaction: Institutions like Charles Schwab and the American Bankers Association see this as a crucial step toward mainstream crypto adoption.

Bitcoin’s price surged by over 1.5% to $105,800 following the announcement, inching closer to its all-time high of $109,000.

Justin Sun’s Zero-Fee Stablecoin Revolution

Tron founder Justin Sun has unveiled a zero-fee stablecoin transfer plan that could redefine retail payments. Here’s why this is a game-changer:

- Market Dominance: Tron accounts for $60 billion of the $214 billion stablecoin market, with 43.33% of Tether (USDT) minted on its network.

- Ethereum Rivalry: Tron’s low-fee structure has made it a viable alternative to Ethereum, which currently dominates 46.9% of the stablecoin supply.

- Adoption Potential: By eliminating transaction fees, Tron could accelerate stablecoin adoption in retail payments and solidify its position as a leading blockchain network

What’s Next?

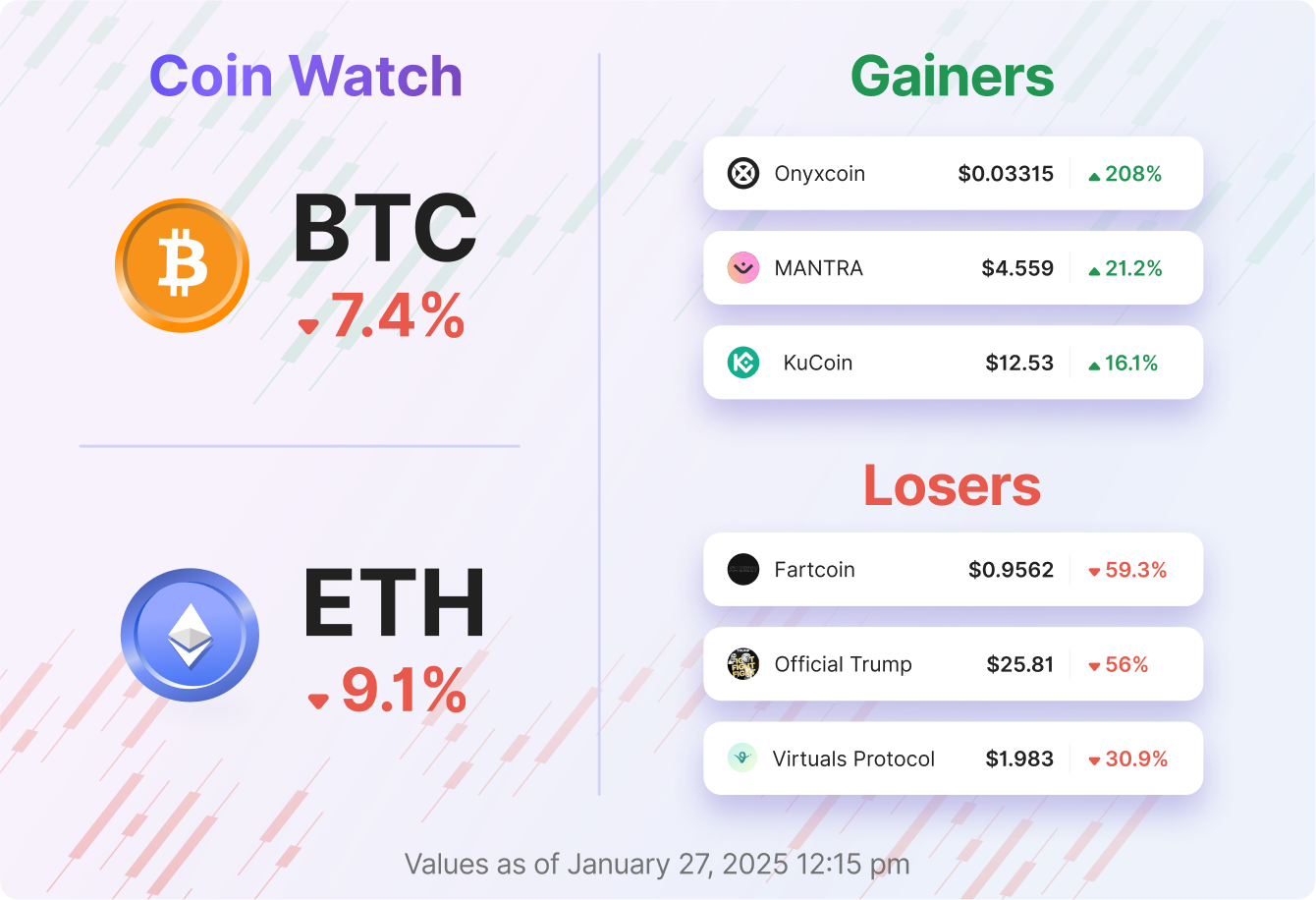

The crypto market is experiencing a pullback, partly influenced by a broader sell-off in U.S. tech stocks. This correlation underscores the interconnectedness of tech and crypto, adding selling pressure to the market.

On the horizon is the U.S. Federal Reserve’s FOMC meeting, where decisions on interest rates and monetary policy could sway market sentiment. While corrections might seem concerning, they’re a normal part of bull markets and often present buying opportunities for long-term investors.

Meanwhile, the AI sector is stealing some of crypto’s thunder. Chinese startup DeepSeek has become the No. 1 free app on the Apple App Store, sparking debates about potential overvaluation in the AI space. This shift in investor focus adds another layer of caution to the market.

The crypto world is evolving rapidly, and these developments highlight its dynamic nature. Whether you’re a trader, investor, or enthusiast, staying informed is key to navigating this ever-changing landscape. Keep an eye on these trends as they unfold